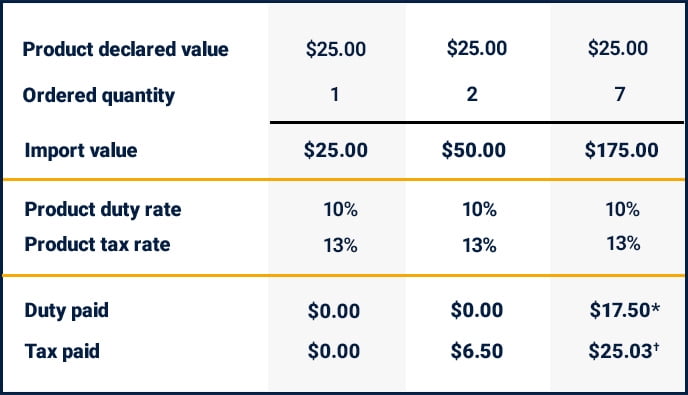

* Declared Value*Duty Rate=Duties.

Example: $175*10%= $17.50 Duties due

† (Declared Value + Duties) * Tax Rate = Taxes

($175+17.50)*13%=$25.03 Taxes due

Taxable

There are three tax codes in Canada: GST, PST, and HST. A Goods and Service Tax (GST) is levied on most imports. An additional Provincial sales tax (PST) may also be assessed In some provinces, the GST and PST taxes are combined into a single flat rate known as the Harmonized Sales Tax (HST).

Learn more

Dutiable & Taxable

Duties, sometimes known as tariffs, are charged on imported goods to keep competition fair with products produced within the importing country. Duties are charged based on classification code; the Ship with Walmart program classifies your catalog and estimates your cost.

Learn more

Items Regulated by Participating Government Agencies

Food & Food-related items

Alcohol

Herbicides

Beverages

Tobacco

Pet food & pet medicines

Nutraceuticals

Prohibited goods (i.e., select knives and bows, guns, etc.)

Radiation-emitting items (i.e., microwaves, etc.)

Pharmaceuticals

Taxidermist products

Endangered species & articles made thereof

Controlled substances

Pesticides

Flowers & plants

Enroll today

The world of Walmart

Walmart Canada helps Canadians save money and live better. Quality products at everyday low prices – that’s the promise Sam Walton made when he started Walmart and it’s as true today more than 50 years later. We believe in innovation and continue to grow by adding new services like pickup, online grocery, and mobile app shopping. Walmart.ca is visited by more than 900,000 Canadians daily, who can choose from millions of items sold by Walmart and third party sellers to fit their needs. We make sure their service experience is as amazing as it is in our stores around the world.